Payments Overview

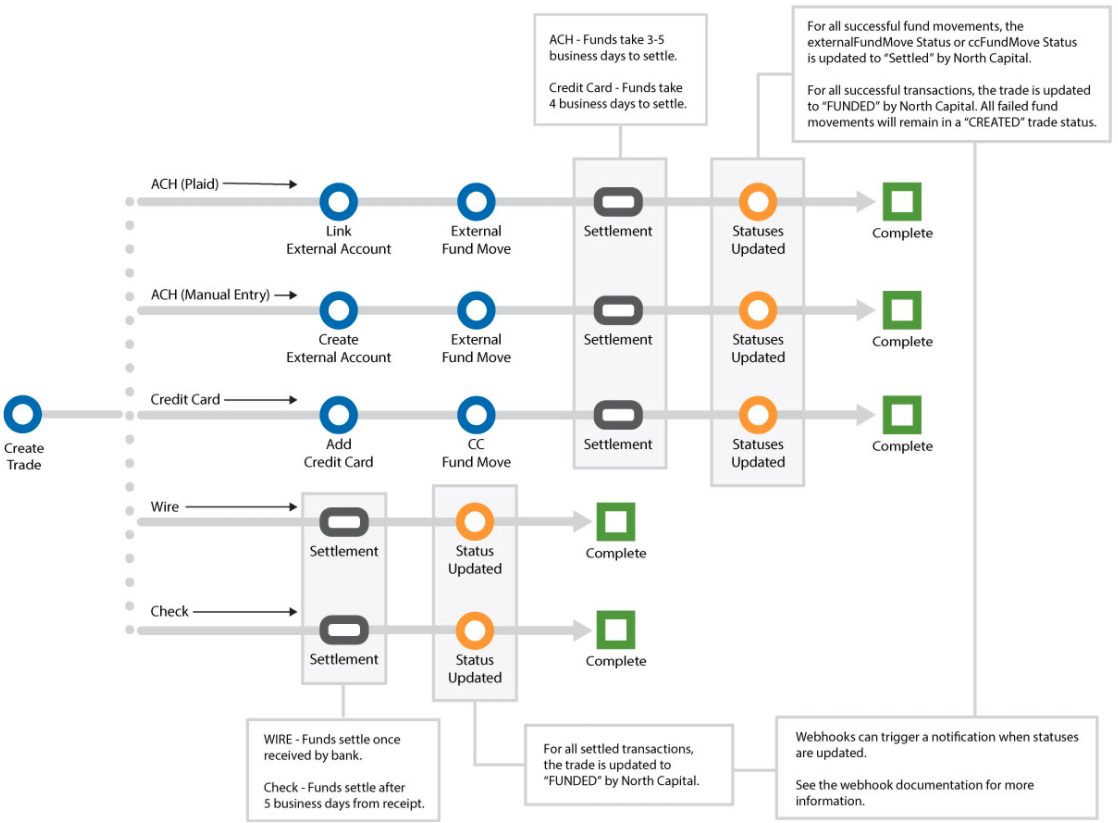

Payment processing via ACH transfer and credit card are supported through TransactAPI. At a high level, the process is very straightforward - you link the payment method, and initiate a payment. However, there are several different outcomes that can impact the settlement of a payment into the offerings escrow. This includes incorrect banking details, insufficient funds, customer chargeback, etc. For this reason, each payment has its own status to inform you of where it stands. In the event of a failed payment, you can reinitiate a payment without needing to create a new trade. The graph below shows the work flows for the different payment methods.

Please note: If North Capital is acting as escrow agent and accepting the funds, we require our payment rails to be utilized for ACH and credit card processing.

Tracking Payment Status

Pending - Payment is pending to be submitted for processing - during this time, the ACH / CC can be voided

Settled - ACH/CC has been submitted and can no longer be voided - during this time, the ACH/CC will take 3-5 business days to either settle or return.

Returned - Payment has failed and a corresponding error will be associated

Submitted - Payment has been submitted and can no longer be voided - during this time, the payment will take 3-5 business days to either settle or return

Voided - Payment has been voided and will not be processed

Declined - This means that our operations team has declined to process this transaction.

It is important to understand the difference between trade statuses and payment statuses. This information is broken down here

Note: The webhooks at the end of this page can be used to track payment statuses.

Webhooks

createTrade

externalFundMove

ccFundMove

updateCCFundMoveStatus

updateExternalAccount

updateExternalFundMoveStatus

updateTradeTransactionType

updateTradeStatus

Updated 6 months ago